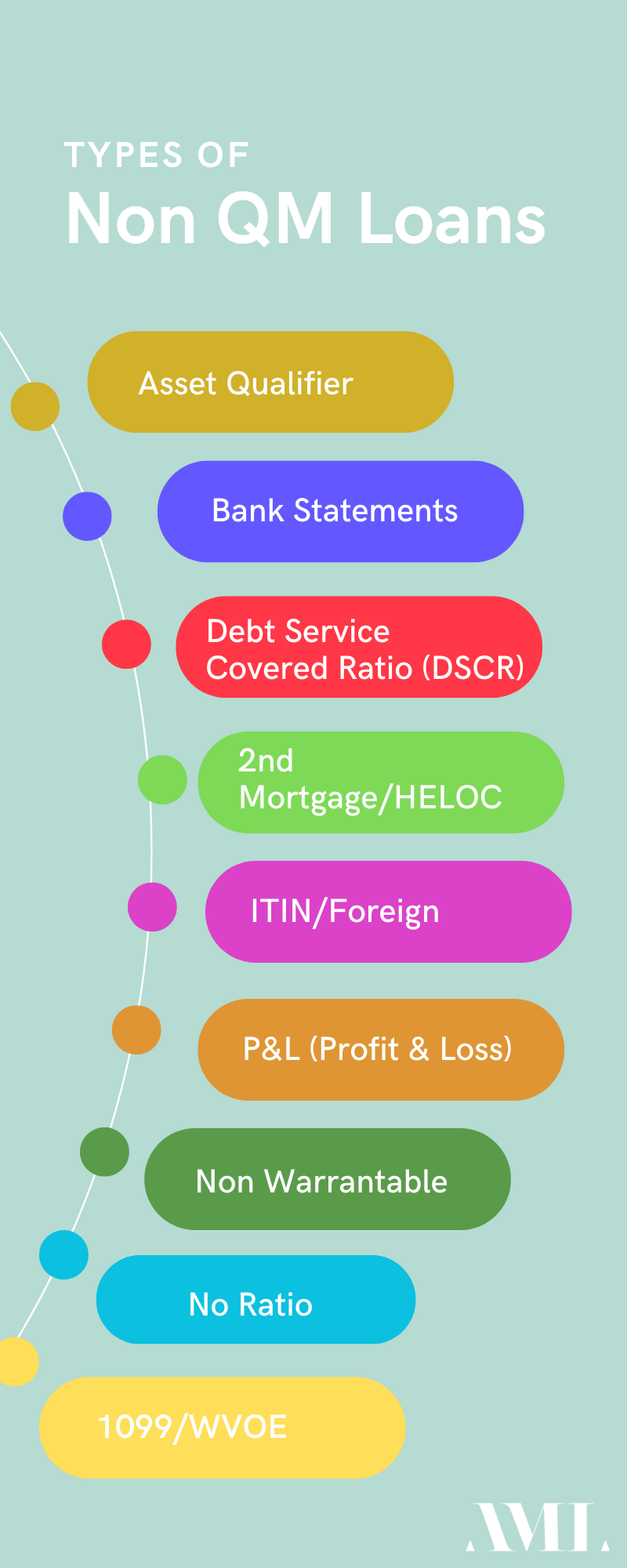

What is a Non-Qualified Mortgage (Non-QM)?

Nonqualified mortgages (non-QM) are alternative mortgage loan

programs designed to help borrowers who can’t qualify using

standard document programs.

Government and conventional loans have set agency mortgage

guidelines, which may disqualify many borrowers. For example, if you are self-employed or need all the necessary documentation to qualify for a traditional mortgage, you should look at nonqualified mortgages.

Without Non-QM loans, certain people could not purchase their homes. These loans are not backed by any government agency and are considered portfolio loans.

NON-QM Pros & Cons

PROS:

- Same Application as a traditional mortgage

- Lenient Guidelines requiring less proof of income and docs

- Products available for foreign national

- Investors are not limited to the number of financed doors they own

CONS:

- Interest Rates and fees may be higher

- NON-QM loans can be challenging to find

- Down Payment requirements may be higher

- Require higher credit scores

Who Benefits from Non-QM Loans

The following types of borrowers benefit:

-

- Investors who are CAPPED at the allowed number of doors financed

- Mortgage Borrowers who are self-employed and do not meet the

debt-to-income ratio requirements due to the business expenses

- Homebuyers with a prior bankruptcy and/or foreclosure who have

reestablished themselves but did not meet the minimum waiting

period requirements after bankruptcy and/or a housing event - Homebuyers who have late mortgage payments in the last 12 months on their previous mortgage

- Retirees, self-employed, entrepreneurs, and wealthy individuals who

have assets but no traditional income and/or regular job - High-end homebuyers who cannot qualify for traditional jumbo loans

© 2016 – 2023 Absolute Mortgage & Lending NMLS# 1910591

© 2016 – 2023 Absolute Mortgage & Lending NMLS# 1910591