Home Equity Loans

Taking out a second mortgage means you can access a large amount of cash using your home as collateral. Often these loans come with low interest rates plus a tax benefit. You can use a second mortgage to finance home improvements, pay higher education costs, or consolidate debt.

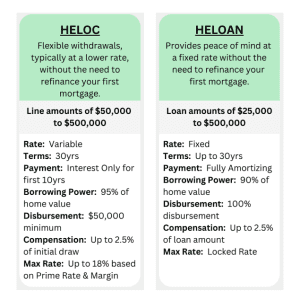

A HELOC, or Home Equity Line of Credit, is a revolving credit secured by the equity in a person’s home. Essentially, it allows homeowners to borrow against the value of their home, using the home as collateral.

With a HELOC, homeowners can access a line of credit that they can draw from as needed, up to a predetermined limit. They are then required to make regular payments on the amount borrowed, typically with a variable interest rate.

HELOCs can be useful for homeowners who need to borrow money for a variety of purposes, such as home renovations, education expenses, or to pay off high-interest debts.

HELOAN is a Home Equity Loan where the borrower would receive a lump sum of the loan amount at the time of loan signing.

Properties include condotels, timeshares, fractional ownership properties, multi-unit condos.

- Loans starting at $25k up to $500k

- Credit Scores starting at 640-660

- Max total combined liens $1.5M

- Up to 95% CLTV Full Doc or 85% Bank Statement

- Property types: Primary, Second Homes, and Investments

Eligible Property types: SFR, Condo, PUD, and Modular

** Certain restrictions may apply based on states

© 2016 – 2023 Absolute Mortgage & Lending NMLS# 1910591

© 2016 – 2023 Absolute Mortgage & Lending NMLS# 1910591